- Applications

- Finance

Paisabazaar-Loans,Credit Score

| Install | <100 |

| From 0 Rates | 0 |

| Category | Finance |

| Size | 52 MB |

| Last Update | 2025 November 11 |

| Install | <100 |

| From 0 Rates | 0 |

| Category | Finance |

| Size | 52 MB |

| Last Update | 2025 November 11 |

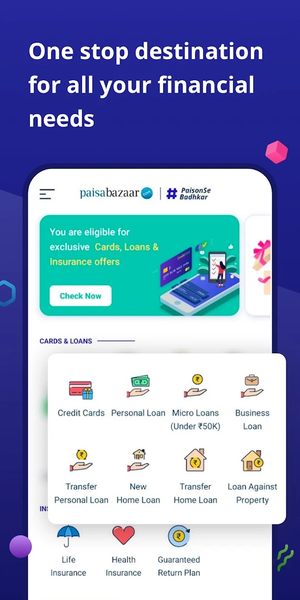

Images

Introduction

Paisabazaar is India’s leading pure-play marketplace platform for consumer credit and free credit score platform. We help consumers find the best offers, through wide choice, ease of comparison & seamless, digital processes.

We are an independent, transparent and unbiased platform that over the last 10 years has:

•Earned the trust and goodwill of over ~43 million consumers from 823 cities and towns across India

•Built 60+ partnerships with Banks, NBFCs and Credit Bureaus to offer wide choice

•Become India’s platform of choice, with over ~2 million monthly credit inquiries

•Provided ‘best offer always’ - for all consumers through our industry-first chance of approval model, maximising approval rate

•Built end-to-end digital processes, providing a superlative consumer experience

What you get with the Paisabazaar App

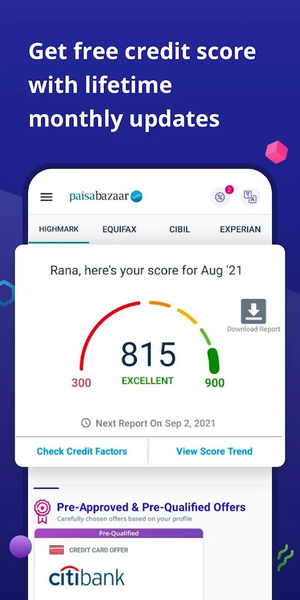

Check your Free Credit Score from CIBIL and other credit bureaus every month. Choose from a wide range of personalized Loan & Credit Card offers, from India’s top Banks (IDFC FIRST Bank Limited, Federal Bank Limited, HDFC Bank Limited, Yes Bank Limited) & NBFCs (Tata Capital Financial Services Limited, DMI Finance Pvt Ltd)

Credit Score

•Free Credit report from multiple credit bureaus including CIBIL with free monthly updates

•Access your credit report in regional languages, like, Hindi, Marathi, Gujarati, Telugu etc.

•Credit Advisory & Credit Assist services to help improve/build your credit score

Personal Loan

•Personalized loan offers from top Banks and NBFCs ranked according to your ‘Chance of Approval’

•Pre-approved offers with Zero/Minimum documentation and Instant disbursals

•Free expert assistance till loan disbursal

Credit Card

•Choose from a wide range of 60+ credit cards

•Pre-approved card offers

•Completely digital process with minimal to zero documentation

Home Loan

•Low interest rate home loan offers from top lenders

•Home Loan balance transfer option for existing home loan customers paying higher interest rate

Step-Up Card

•A secured credit card backed by Fixed Deposit with high interest rate, exclusively offered by Paisabazaar in partnership with SBM Bank

•Step-Up card comes with 100% approval and is ideal for new to credit and low credit score customers who do not get a regular credit card

Download the Paisabazaar App to become credit healthy and avail loan and card offers from India’s leading banks and financial institutions via seamless digital processes

Contact us:

Toll Free: 1800 208 8877

Email: app@paisabazaar.com

WhatsApp: 851 009 3333

Address: 135 P, Sector 44, Gurugram (HR) 122001

*************************

Personal Loan Features & Benefits

•No end-use restriction

•Minimal documentation

•Quick disbursals

•Loan amount of up to Rs. 40 lakh or more based on lenders' discretion

•Loan tenure can go from 6 months to 5 years

Personal Loan Eligibility:

•Age: 18 - 60 years

•Income: Minimum salary of Rs 15,000 per month

•Credit Score: Preferably 700 & above

Customers applying for a Personal Loan should note that:

Those planning to avail personal loans should also look into APR when considering loan options. The APR (Annual Percentage Rate) of a personal loan is the loan’s annualised cost of borrowing, which includes the interest rates and other fees charged during the loan origination such as the processing fees and documentation fees. APR is expressed in percentage and allows loan applicants to identify personal loan schemes offered at lower interest rates but with higher processing fees and/or other charges.

The APR of personal loans usually ranges between 11% to 36%. For example, suppose you avail a personal loan of Rs 4 lakh @ 11% p.a. with a repayment tenure of 5 years and processing fee of 1.5% of loan amount. With these loan details, the processing fee for your loan will be Rs 6,000, total interest cost would be Rs 1,21,818 and the total cost of borrowing will be Rs 5,21,818 and the APR for your loan will be 11.66%.

Related Applications

Users Also Installed