| نصب | ۶۴۰ |

| از ۰ رأی | ۰ |

| دستهبندی | امور مالی |

| حجم | ۱۳۱ مگابایت |

| آخرین بروزرسانی | ۲۲ مهر ۱۴۰۴ |

| نصب | ۶۴۰ |

| از ۰ رأی | ۰ |

| دستهبندی | امور مالی |

| حجم | ۱۳۱ مگابایت |

| آخرین بروزرسانی | ۲۲ مهر ۱۴۰۴ |

تصاویر برنامه

معرفی برنامه

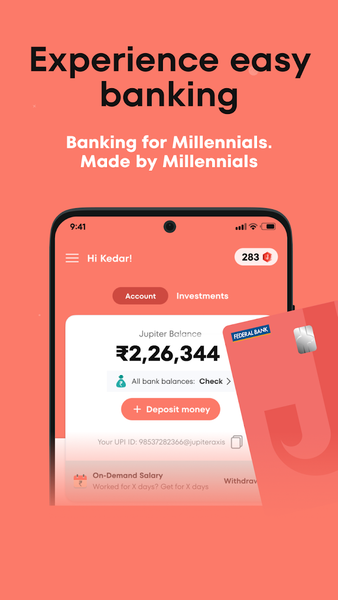

Jupiter Money - for everything money!

Open a zero balance savings account online (Savings Account is opened with Federal Bank). Jupiter brings you instant account opening with zero balance in 3 minutes. We are the easiest, personalised money management app that helps you take control of your finances. Track spending and expenses, pay bills, save for goals, and invest & grow your money! Now, you can withdraw your salary any day with On-Demand Salary.

What’s on the Jupiter app?

The easiest way to manage your money!

💎 Earn 5X Rewards on your spends* with UPI payment and Debit card payment

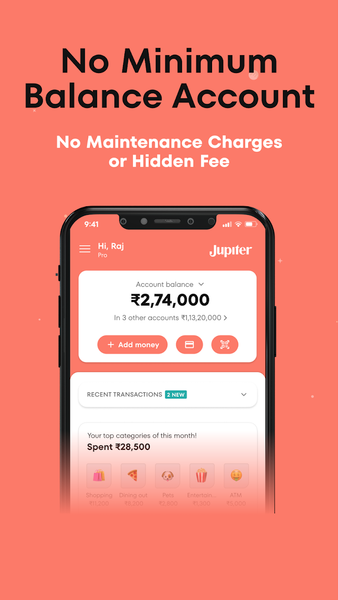

👌🏼 Zero balance savings account

🏦 Open digital bank account online

👮♂️ Your money is insured up to Rs. 5 Lakh by DICGC (a wholly owned subsidiary of RBI)

💬 Get a helpful 24x7 Chat Support

💸 Use Jupiter as your UPI payment app

✈️ Zero Forex Fee

📊 Track your expenses with spend categories

😇 No hidden fee, charges

💰 Manage money and bills with easy netbanking

🏦 Get high interest (up to 7.25%) p.a. with Fixed Deposits

📈 Auto-invest daily, weekly, or monthly with zero commission Mutual Funds

⭐ Buy once or auto-save regularly in 99.99% purest 24K Digital Gold

📍 Track your Loans and never miss an EMI payment

🏦 Track all your bank accounts at 1 place

🧾 Make 20+ Bill Payments online

🎁 Buy Gift Cards

Upgrade to the most rewarding corporate Salary Account online:

→ Get a Zero Balance Salary Account

→ Earn up to 5% cashback on spends*

→ Get Instant Credit of up to ₹1,50,000* and make any day salary day with our On-Demand Salary

→ Get your advance salary easily and pay 0% interest in next month's repayment.

→ Repay salary advance in up to 6 easy EMIs

→ Zero penalties on early repayment of advance salary loan

→ Zero Forex Charges (save up to ₹3500 every month)

→ Get a free Metal Card

→ Earn ₹1,000 per referral

Trusted by people at top companies like Amazon, Swiggy, Microsoft, Deloitte, Wipro, Infosys, Adobe, Myntra, and Unacademy

How to manage money and do money right?

Anything expenses? You’ve got this!

With Jupiter’s Digital Savings Account

-Track spends by Category

-Add #Tags to track spends your way

-Create Auto-Pay rules for repeat payments

-Pay with your Jupiter UPI ID for online payments

Anything savings? We’ve got your back!

Save for all your goals in Pots

- Earn higher interest rate on your savings

- Pick your own savings interest rate

- Withdraw your money anytime

Anything investing? It’s made super simple now!

Mutual Funds on Jupiter: The smarter way to invest online!

- Earn up to 1.5% extra returns with 0-commision Direct Mutual Funds

- Invest once, or auto-invest daily, weekly, or monthly

- Start small with SIPs starting at just ₹10

- Enjoy 0-Penalty on missed Mutual Fund SIPs

24K 99.99% Purest Digital Gold on Jupiter

- Buy and sell anytime

- Stored in lifetime-free secure vaults

- Invest once, or auto-save daily, weekly, or monthly

Assured growth on your savings with Fixed Deposits (FDs)

- Get up to 7.25% interest with online investment in FDs

- Grow your wealth with our fixed deposits from Federal Bank

- 100% digital, instant withdrawals

Your money? You are in control!

- Enable/disable swipe, online & contactless payments on your VISA Debit Card

- Transfer money easily with mobile banking

- Lost/misplaced your card? Tap to order a new one. Or freeze it in-app.

- Your privacy is taken seriously! Your personal finance is your business. Nobody should ever see it!

Made for millennials, by millennials

Manage money like you shop, order food, buy groceries online

No jargon, no big-big-words. Money matters explained simply.

Disclaimers:

The Savings Account, Fixed Deposit and VISA Debit Card are provided by Federal Bank - an RBI-licensed bank. Jupiter itself is not a bank and doesn’t hold or claim to hold a banking license. Your money is always safe with our partner bank.

Digital Gold in partnership with MMTC PAMP

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

برنامههای مرتبط

دیگران نصب کردهاند

برنامههای مشابه