- Applications

- رفت و آمد

Mileage Tracker by Driversnote

| نصب | ۸۷۰ |

| From ۵ Rates | 4.6 |

| Category | رفت و آمد |

| Size | ۴۲ مگابایت |

| Last Update | ۲۴ آذر ۱۴۰۴ |

| نصب | ۸۷۰ |

| From ۵ Rates | 4.6 |

| Category | رفت و آمد |

| Size | ۴۲ مگابایت |

| Last Update | ۲۴ آذر ۱۴۰۴ |

Images

Introduction

Your easy-to-use mileage tracker:

Automatically track your mileage with Driversnote and we’ll generate the reports you need for your IRS tax deduction and company reimbursement.

⭐⭐⭐⭐⭐

• "Best log app I've used yet" - David W, February 2021

• “Easy to use, keep records & email direct to office” - Chris E, July 2020

• “Totally reliable, it does everything our small business requires” - Steve G, March 2020

🚘 Driversnote mileage log is ideal for businesses, employees, employers, self-employed and just about anyone who drives.

🤝 Trusted by over 750,000 drivers for our mileage tracking & reporting solution.

🤓 Always up to date with the IRS mileage rates. Easily generate IRS-compliant reports ready for mileage reimbursement.

🏆 The best mile tracker for Android. Driversnote is the only app you will ever need for mileage tracking & reports.

💰 Maximize Your Mileage Reimbursement:

For every mile you log this year, you can get reimbursed up to 56 cents (updated Jan 1, 2021). Start your mile tracking today.

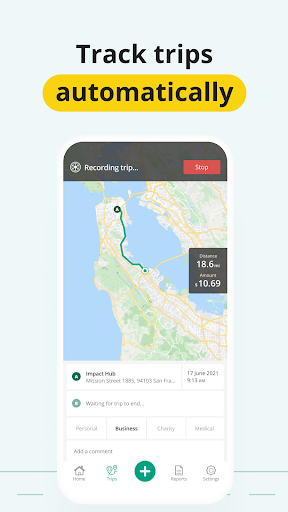

⏰ Save Time & Increase Efficiency:

Want to track your trip? Just tap START and STOP and leave the rest to our smart GPS tracker.

💯 100% Automatic Start & Stop with iBeacon Support:

Get a free iBeacon when you sign up for the annual Basic subscription.

🗒 Online Mileage Log:

Your complete mileage log is always ready for you online. Easily print or download your car logbook as a PDF or Excel document.

📱 Log trips easily with your phone

• Use our mileage tracker to follow your trip through GPS as you drive.

• Manually record a trip and our app will calculate the distances between your start and end points automatically.

• Mileage reimbursement, distances and odometer readings are calculated automatically - it doesn’t get much easier than that!

• Add or edit trips in the log at any time, if you forgot to use our smart GPS tracker.

• More than one car or workplace? No worries, you can use mile logs in one account for multiple cars and workplaces.

✔️ Fully compliant with IRS requirements for tax deductions

• Easily categorize your trips within the car logbook.

• More than just a mile tracker; we generate complete mileage documentation that also complies with IRS requirements.

• Option to attach a comment to each recorded trip.

• Add Odometer readings with ease, if you need them. You decide how often you check your odometer, and let us do all the math in between.

• Learn more: IRS Mileage Guide

🚗 Mileage tracker with 100% automatic start & stop capability

• Place an iBeacon in your car and Driversnote will Start, Stop & track your miles all by itself - every time you enter or leave your vehicle.

• Zero-touch journey tracking - leave your phone in your pocket, we’ve got you all the way.

💻 See your complete mileage log online

• All your registered trips are saved on our servers automatically.

• Get the full overview of your trips on www.driversnote.com.

• Forgot to track a trip? Log trips manually for maximum mileage allowance.

🌏 What countries do we support with our mileage tracker?

• Our mile tracker supports most countries and we already have default government mileage rates entered for USA, Canada, UK, Australia, Denmark & Sweden.

• If your employer uses a different rate to the IRS mileage rate, you also have the option to enter your own rates for your mileage tracking.

• All addresses, currencies etc. will be formatted for local standards. If you have any questions about our mile tracker solution, feel free to contact us.

🙋 Support

If you have questions or feedback about our mileage tracker & log solution, please visit our Help Center or contact us on support@driversnote.com or at (+45) 71 99 37 54.

برنامههای مرتبط

دیگران نصب کردهاند

برنامههای مشابه